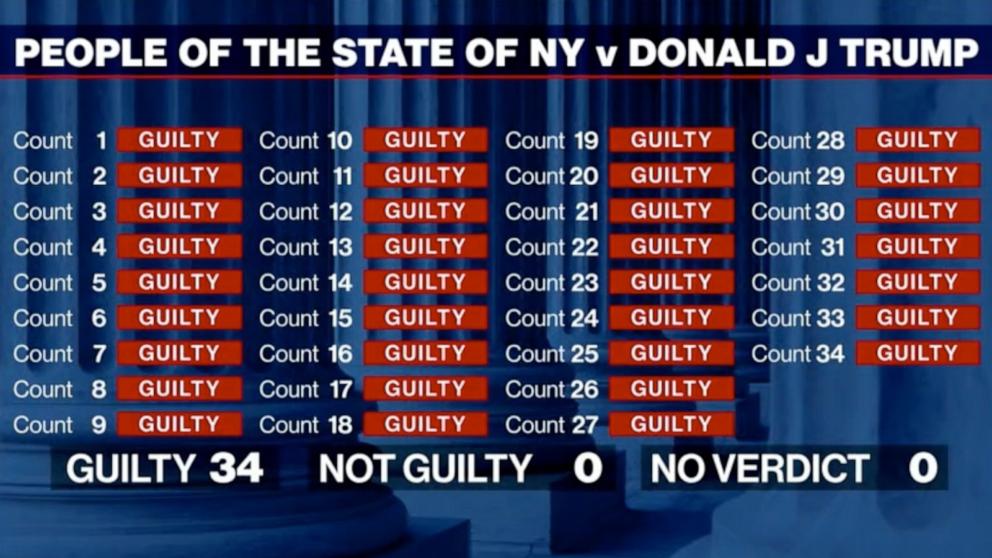

Trump guilty of 34 counts of Accounting errors. Then when they knew they couldn’t stop him from running for President, they dropped the case.

Donald Trump was convicted of 34 felony counts of falsifying business records in 2024, making him the first U.S. president to receive a felony conviction. Despite this, he was granted an unconditional discharge, meaning he faced no jail time or penalties. Here is the link to the Indictment Document.

FALSIFYING BUSINESS RECORDS IN THE FIRST

DEGREE, in violation of Penal Law §175.10

I decided to read the Indictment against Donald Trump to see what the Jury based their conviction on.

New York accused Donald Trump of:

“FALSIFYING BUSINESS RECORDS IN THE FIRST DEGREE”

The statute of limitations for this crime is 5 years. If the alleged crimes took place in 2017 then the clock ran out in 2022. They had to change the law on the statute specifically to charge Trump.

Each Count carries a maximum sentence of 4 years in Prison. Trump is charged with 34 Counts of Fraud so if he got the maximum penalty, he could spend 34 X 4 years or 136 years in Prison.

Each Count is based on a bookkeeping entry. His bookkeeper entered the record of Michael Cohen’s Invoice. Then they entered the record of a voucher to pay him, and finally the entry for the Check used to pay the Invoice. So those 3 entries alone could land Trump in prison for 12 years. And for each other time Cohen’s Invoices were recorded in the books, they created 3 more entries. Thirty-four bookkeeping entries in total; 3 Life Sentences for Trump.

Here is my Edited version. I wrote it in plain English so you can see that it’s just 3 Bookkeeping Entries repeated over and over again to create a massive Case against the once and future President.

I have also attached the Full Indictment the Jury received so you can see it in it’s original form.

Anyone who reads this Indictment and still thinks it has anything to do with the law is either psychotic or totally indoctrinated by the Mainstream Media. Or both. Read it and see for yourself. Steve

SUPREME COURT OF THE STATE OF NEW YORK

COUNTY OF NEW YORK

THE PEOPLE OF THE STATE OF NEW YORK

-against-

DONALD J. TRUMP, defendant.

CRIME: FALSIFYING BUSINESS RECORDS IN THE FIRST DEGREE.

FIRST COUNT: THE GRAND Jury OF NEW YORK ACCUSES DONALD TRUMP OF MAKING A FALSE BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN FEBRUARY 14,2017, ,[FOR $70,000:] THAT WAS ENTERED [AS “LEGAL EXPENSES”] “WITH INTENT TO DEFRAUD AND COMMIT ANOTHER CRIME.” [THE INTENDED CRIME IS NEVER MENTIONED.]

SECOND COUNT: FEB 14,2017:MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE :VOUCHER 842457)

THIRD COUNT: FEB 14,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 842460)

FOURTH COUNT: FEB 14,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE :(CHECK 000138)

FIFTH COUNT: MARCH 17,2017:MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

SIXTH COUNT: MARCH 17,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 846907)

SEVENTH COUNT: MARCH 17,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 000147)

EIGHTH COUNT: BETWEEN APRIL 13 AND JUNE 19,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

NINTH COUNT: JUNE 19,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 858770)

TENTH COUNT: JUNE 19,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002740)

ELEVENTH COUNT: MAY 22,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

TWELFTH COUNT: MAY 22,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 855331)

THIRTEENTH COUNT: MAY 23,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002700)

FOURTEENTH COUNT: JUNE 16,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

FIFTEENTH COUNT: JUNE 19,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 858772)

SIXTEENTH COUNT: JUNE 19,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002741)

SEVENTEENTH COUNT: JULY 11,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

EIGHTEENTH COUNT: JULY 11,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 861096)

NINETEENTH COUNT: JULY 11,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002781)

TWENTIETH COUNT: AUGUST 1,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

TWENTY-FIRST COUNT: AUGUST 1,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 863641)

TWENTY-SECOND COUNT: AUGUST 1,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002821)

TWENTY-THIRD COUNT: SEPT 11,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

TWENTY-FOURTH COUNT: SEPT 11,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 868174)

TWENTY-FIFTH COUNT: SEPT 12,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002908)

TWENTY-SIXTH COUNT: OCT 18,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

TWENTY-SEVENTH COUNT: OCT 18,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 872654)

TWENTY-EIGHTH COUNT: OCT 18,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002944)

TWENTY-NINTH COUNT: NOV 20,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

THIRTYITH COUNT: NOV 20,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 876511)

THIRTY-FIRST COUNT: NOV 21,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 002980)

THIRTY-SECOND COUNT: DEC 1,2017: MAKING A BOOKKEEPING ENTRY OF AN INVOICE FROM MICHAEL COHEN [ FOR $35,000]

THIRTY-THIRD COUNT: DEC 1,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (VOUCHER 877785)

THIRTY-FOURTH COUNT: DEC 5,2017: MAKING A BOOKKEEPING ENTRY FOR THE COHEN INVOICE : (CHECK 003006)

ALVIN L. BRAGG. JR. District Attorney